In the first half of 2025, the Chinese new energy vehicle market will continue its high growth trend. According to statistics from the China Association of Automobile Manufacturers, from January to June, the production and sales of new energy vehicles in China reached 6.968 million and 6.937 million respectively, with a year-on-year growth rate of over 40%. The proportion of new energy vehicles in overall automobile sales has reached 44.3%, almost occupying half of the market. The China Association of Automobile Manufacturers predicts that the annual sales of new energy vehicles are expected to exceed 16 million units by 2025, and the penetration rate will climb to 56%. In the context of this booming development, the drive motor, as the core component of new energy vehicles, has also ushered in unprecedented development opportunities. Data shows that from January to May 2025, the installed capacity of drive motors in China has reached 4.9424 million units, a year-on-year increase of 29%.

The drive motor is known as the "heart" of new energy vehicles, and its performance directly determines the power output, range, response speed, and driving experience of the entire vehicle. It is not only the technological cornerstone of electrification transformation, but also a key force driving the continuous upgrading of the automotive industry.

1、 The working principle and mainstream types of drive motors

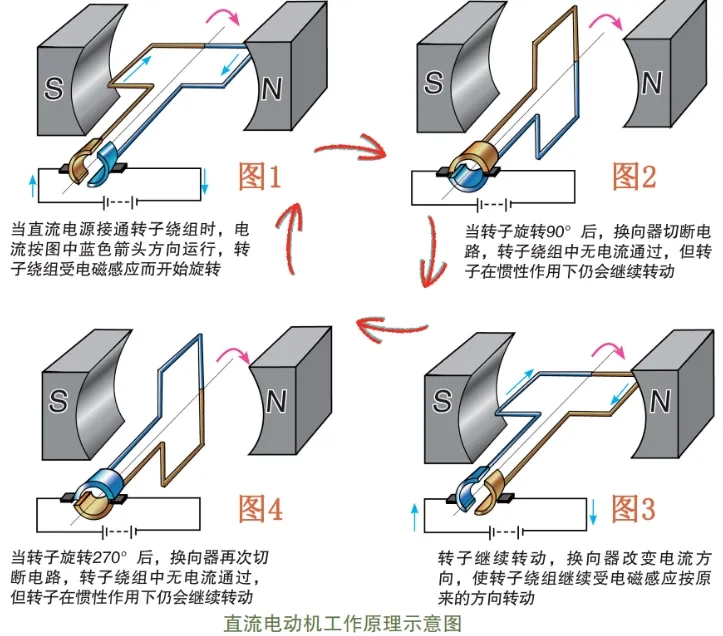

The driving motor is essentially a device that converts electrical energy into mechanical energy. The workflow begins with the direct current provided by the vehicle's power battery, which is distributed through a high-voltage distribution box and input into the motor controller. It is then converted into three-phase alternating current through a DC-AC inverter, which drives the motor rotor to rotate and ultimately drives the wheels through the transmission system. During the braking or coasting phase, the motor can switch to power generation mode to recharge kinetic energy back to the battery, achieving energy recovery.

According to the type of power supply, drive motors can be divided into two categories: DC motors and AC motors. DC motors were used in early electric vehicle models due to their simple control and convenient speed regulation, but their brushes were prone to wear and their efficiency was low, and they have gradually been replaced by AC motors.

At present, the mainstream AC motors mainly include permanent magnet synchronous motors and induction asynchronous motors:

Permanent magnet synchronous motor: It has the characteristics of high power density, high torque, and excellent efficiency, which helps to improve the acceleration and endurance performance of vehicles. But its rotor requires the use of rare earth permanent magnet materials (such as neodymium iron boron), which is costly and carries the risk of demagnetization in high temperature environments.

Induction asynchronous motor: sturdy structure, low cost, high temperature and impact resistance, simple weak magnetic control, excellent high-speed performance. The disadvantage is that the power density and efficiency are relatively low, the volume and weight are large, and an external cooling system is often required.

The two types of motors complement each other well in terms of performance, providing diverse choices for vehicles with different positioning.

2、 Technological Evolution: From DC Motor to Efficient Permanent Magnet

The technological development of drive motors spans over a century. In the 19th century, DC motors were the mainstream choice for early electric experimental vehicle models. Until 1885, Italian scientist Galileo Ferraris invented asynchronous induction motors, and AC motor technology gradually entered the historical stage.

In the 1980s, some car companies still used DC motors in their electric prototype vehicles. After the 1990s, with the advancement of power electronics and control technology, induction motors and permanent magnet motors began to become two parallel development routes.

In 1982, the emergence of neodymium iron boron permanent magnet materials laid the foundation for permanent magnet motors. 1996 was an important milestone in the industrialization of electric motors: General Motors launched its first mass-produced induction motor model, the EV1, while the Toyota RAV4 EV was equipped with a permanent magnet synchronous motor. The latter gradually became the mainstream in the market due to its superior comprehensive performance.

Entering the 21st century, permanent magnet motors have achieved multiple breakthroughs in materials and cooling. In 2003, Toyota introduced rotor oil cooling technology in the second-generation Prius, significantly improving motor heat dissipation and demagnetization issues. In 2006, Zhongke Sanhuan reduced the amount of dysprosium element to 1% by optimizing the rare earth composition formula, significantly reducing costs.

Since 2010, lightweighting and integration have become technological priorities. The BMW i3 achieved significant weight reduction in 2013 by adopting an aluminum alloy motor housing; In the same year, Bosch launched the electric drive multi in one module. In 2018, BYD released a highly integrated "three in one" electric drive system to further enhance power density.

Tesla continues to innovate in the field of asynchronous motors. In 2008, the Roadster was equipped with high-performance induction motors. In 2014, the Model S adopted a dual motor architecture. After 2019, it gradually shifted to a hybrid configuration of "front permanent magnet+rear induction" to balance efficiency and performance.

3、 Current technological focus: Flat wire, oil cooling, and integrated systems

Since 2020, driven by the "dual carbon" goal, drive motors have continuously broken through towards high efficiency, lightweight, and deep integration, mainly reflected in three major technological trends:

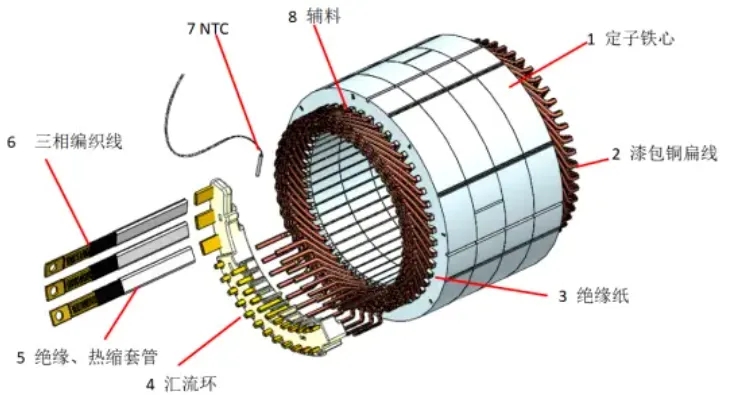

Flat wire motor: using copper wire winding with rectangular cross-section, the slot filling rate is increased by about 30%, achieving higher power density and efficiency. It has been widely used in brand models such as BYD, Volkswagen, Tesla, etc;

Oil cooling technology: By directly contacting the heating components with cooling oil, the heat dissipation efficiency is greatly improved. For example, the BYD DMI system achieves a 32% increase in power density through oil cooling;

Multi in one electric drive system: deeply integrating components such as motors, electronic controls, and reducers to achieve compact structure and weight reduction. The eight in one system launched by BYD e-platform 3.0 is a typical representative, with a comprehensive efficiency of 89%.

In addition, the 800V high-voltage platform, silicon carbide electronic control, and speed increase (such as Xiaomi motors reaching 27200rpm) have also become new trends in the industry. The intelligent electronic control system can dynamically optimize its output based on real-time road conditions and driving behavior, further improving energy efficiency.

4、 Market Pattern: Concentration of Top Companies and the Rise of Self Developed Automakers

In the first half of 2025, the installed capacity of drive motors in China reached 6.271 million sets, a year-on-year increase of 30.6%, and the market showed high concentration characteristics:

Freddie Power (a subsidiary of BYD) ranks first with 1.737 million installed units and a market share of 27.7%. Its flat wire motor efficiency reaches 97.5%, demonstrating significant advantages in the integration of the entire industry chain;

Huichuan United Power ranks second with 698000 sets, with a market share of 11.1%. Relying on the accumulation of industrial transmission technology to expand cooperation with automobile companies, the revenue of new energy business will increase by about 70% in 2024;

Tesla ranks fourth with approximately 320000 units and a 5.1% market share. Its new Model 3 long-range version has an increased motor power of 225 kW, continuously enhancing its technological leadership capabilities.

The second tier includes companies such as United Electronics, Grebo, Honeycomb, and NIO Power Technology, with a market share between 3% and 4%, maintaining competitiveness through segmented markets or technological expertise.

It is worth noting that there is a significant trend for car companies to accelerate their own research or supply within the system. The combined market share of related motor companies such as Ford, Tesla, NIO, and Leapmotor has exceeded 40%, reflecting the strategic direction of OEMs to strengthen cost control and supply chain security through vertical integration.

5、 Future outlook: Innovation, cost and supply chain synergy

The drive motor industry is facing profound changes. New technologies such as the 800V platform, silicon carbide applications, and high-speed flat wire motors are not only driving product performance leaps, but also restructuring the industry's competitive model.

In the future, enterprises that can grasp technological trends, optimize supply chain collaboration, and achieve cost control will occupy a more advantageous position in the wave of electrification. As the core power source of new energy vehicles, the drive motor will continue to provide key support for the transformation and development of the global automotive industry.